Ten shares, no comments? Where's the thoughtful web? Talking points: · A statement like "taxes on entrepreneurs and investors are already historically low" is too fuzzy to fact-check. Anyone who advertises housecleaning online is an entrepreneuer. Anyone with a 401(k) is an investor. · The infographic states that "Between 1997 and 2008 ... All [income] growth went to the richest 10%." Was anyone here making more in 2008 than 1997, and yet not in the richest 10%? One example would disprove this absurd claim. The caption is less confident and less clear, claiming merely that "almost all of the income gains have gone to the richest Americans." · The more disturbing claim in the infographic is that "Between 1997 and 2008 ... Income for the bottom 90% declined." This is apparently illustrated by the thin blue stripe at the bottom of the chart, which actually looks pretty flat during the named range. The citation gives the source for the data, a spreadsheet with 54 sheets. The eighth sheet, labeled Table A4, appears to contain the data about the bottom 90%. It looks like that the bottom 90% of household income (adjusted for inflation) has indeed been pretty flat since the early '70s. The value in 1997 was $31,056, and in 2008 it was $30,981, a change of -0.24%, validating the infographic claim. How concerned should we be? Some thoughts to consider: 1) The people in the bottom 90% in 1997 are not all the same people in the bottom 90% in 2008. Some in the top 10% dropped out, some in the bottom 90% moved up. 2) The population is growing. Kids and immigrants tend to have lower incomes than older, established residents. Even if not a single person's income drops with the arrival of a new worker, the average can drop. It is (mathematically) possible that everyone's income is rising, but the average stays the same because of growth in the low-end population. 3) Divorce rates have increased since the fastest growth of average income before the mid-60s. If one household separates into two, the average household income can drop even if everyone's individual income increases. The big idea of the article is fatally flawed as well. Consumer spending drives the economy, fine. But the rich guy isn't doing his fair share to stimulate because he only bought three cars and a plane? What we need is an institution to take his money and distribute it to 9,000 families so they can buy 3,000 cars instead of just three. Mr. Blodget, I have good news for you. We already have that institution, and it is called a bank. No, that's no good. The problem with the bank is that the millions in wealth "either sits and earns interest or gets invested in companies" ... am I reading this correctly? We want customers to buy cars. Most of them do so on credit, with money from a bank. The bank requires depositors, right? If we want to stimulate consumer activity, putting those millions in the bank seems like a pretty good technique. Or investing in companies. That doesn't count as supporting the creation of jobs because ... ?

Hey, I really appreciate your thoughtful and thorough response. I freely admit that my personal understanding of finance and economics is limited, but I am very interested in learning more. You seem to have a much better handle on it, so I'd like to ask: how do you think that jobs might better be created? Also, I understand that credit allows people to buy much more expensive things, but how might the credit system be implemented in a way that does not lend itself to another financial crisis?

As to creating jobs in a better way, I am afraid I don't know. Perhaps the way they are created now is not so bad. People look to increase their wealth by giving strangers stuff they want, so they start businesses to do that. If they have some success, they offer other strangers jobs to scale the process up and increase their wealth even more. Many people, like Mr. Blodget, look to the government to make things better. I tend to think the government would do well to get out of the way. Another business magazine tells us that government is actively shutting down and stifling the very businesses that are creating jobs. If you pm me a mailing address, I would be happy to send you a book that provides a fascinating example of how credit -- in this case, microcredit -- can help pull people out of poverty.Hey, I really appreciate your thoughtful and thorough response.

Great, thanks for saying so!I freely admit that my personal understanding of finance and economics is limited, but I am very interested in learning more.

I would say the same, on both counts.You seem to have a much better handle on it, I'd like to ask: how do you think that jobs might better be created?

Hm, I was hoping you would ask how it is that I can make myself appear to have a handle on economics, despite having no formal training.Also, I understand that credit allows people to buy much more expensive things, but how might the credit system be implemented in a way that does not lend itself to another financial crisis?

It's all I can do to balance my checkbook, I would not dream of designing a credit system. I will observe that government is also up to its elbows in banking; it is one of the most regulated industries. This was true before the crisis, but after the crisis the answer was obvious: moar regulation.

Appearing to know what you are talking about isn't too difficult; you can use the style of my comment above: · bullet points · links to external sources (especially Excel documents) · an embedded graph · quotes to suggest that you read the article · an enumerated list Actually feeling like you know what you are talking about is not so simple. I recommend following Feynman's advice: Be honest and be humble. Don't say things you don't believe (without a good reason ), and don't believe things without good reason. You can't be wrong if you say you aren't sure. "Bend over backwards" to find out where you might be wrong. The rest is just doing your homework. Research takes time, but that is how you find evidence. And it's so easy these days, at least if you are writing for Hubski and not a peer-reviewed journal. Half of my sources are on Wikipedia. The result is that you feel increasingly ignorant in an increasingly complex world. But when you do draw conclusions, even though they are not certain, they are grounded in something more substantial than hearsay and chatter.The first principle is that you must not fool yourself -- and you are the easiest person to fool.

I've seen sources that show this has been true since the '70s. [EDIT: opened the graph -- that's about right, and hell yes it's something to worry about.] Your question to disprove their statement also doesn't take into account inflation. Income disparity is the biggest (?) problem in the economy today because it tends to render moot any and all fixes to the economy that the Fed/whoever can come up with."almost all of the income gains have gone to the richest Americans."

If you can provide a link to the sources you have seen it might help. I won't be surprised to find that a reasonable understanding of that caption turns out to be true, but I will still criticize it for being sloppy. I mean to say: is income disparity inherently bad?Your question to disprove their statement also doesn't take into account inflation.

About the caption beginning "almost all of the income ..." I only said it is not clear. I can't say if it is true or false, because I don't know what the author means by "almost all" or how "the richest Americans" are defined. It looked to me like the numbers behind the chart were adjusted for inflation, but I am not sure which graph you mean.Income disparity is the biggest (?) problem in the economy today because it tends to render moot any and all fixes to the economy that the Fed/whoever can come up with.

You are saying that income disparity is serious because it stops us from fixing other problems. What are the problems you would like to see fixed? If we could fix those problems and income disparity continued to exist, would it still be a problem?

I was just talking about the graph you posted in your comment. It essentially makes the point I was talking about, unless I'm missing something. It's true that "almost all" income growth (adjusted for inflation) has gone to the top X percent in the last 30-40 years. Sure there're semantics involved but the gist is that income disparity is very real -- true. Among other things! I mean ... I wouldn't want to be one of the other 90 percent, would you? Etc. Those others are ... long questions. Problems with the economy ... I mean, pick your poison. No jobs, no investment, the stock market is back to booming and yet look around -- is it working? Fed's impotent. But yeah, I think it's true that even if we could right the economy, as we have in the past, if it follows the current pattern it may only help the top ten percent. Probably already happening -- I hear JP Morgan's doing pretty well these days ... Joe Dirt is unemployed. People smarter than me have argued that income disparity isn't inherently bad as long as the low end is still a livable wage. The America of the 1950s, basically. No one complained about it back then, because everyone had a white picket fence. I'm not sure. While income disparity isn't inherently bad, envy certainly is, and one follows the other.You are saying that income disparity is serious because it stops us from fixing other problems.

Why stop at the 1950s, why not pine for the 1500s? Income disparity was even less an issue then, and most everyone had the same dirt floor. Envy is a real issue, and it looks like an interesting book -- thanks for mentioning it -- but I can't bring myself to feel sorry for someone when their problem is simply that someone else has more material means. Isn't having hot running water and three meals a day more important than to be earning at a certain percentile relative to your neighbors? There are simple theoretical ways to reduce income disparity. One is to cut everyone's salary in half. Another is to make Bill Gates disappear. Would either of these make the world a better place?I wouldn't want to be one of the other 90 percent, would you?

Are you serious? Households making $120,000 per year are in the lower 90%. There is a line of people at the border waiting to come and join the lower 90% of the United States.

Okay, wait. Wait wait. You seem to be arguing that we should fix income disparity by bringing some incomes down, while it seems to me more utilitarian to bring some incomes up for the same result. One is reducto ad absurdum, the other is what we've been trying and failing to do in the third world for years. So, 1950s > 1500s. You know what I mean. Income disparity is a problem in the sense that poverty is a problem. Inherently income disparity isn't bad if there is no poverty, but one tends to follow the other. Yes, but -- says Schoeck -- welcome to human nature and the root cause of all problems in the history of the world. Envy destroyed Rousseau's noble savage, etc. There's an old joke that I'm paraphrasing wrongly -- having "enough" is just having more than your brother in law. EDIT: I think we've rediscovered the thoughtful web.Are you serious? Households making $120,000 per year are in the lower 90%. There is a line of people at the border waiting to come and join the lower 90% of the United States.

Envy is a real issue, and it looks like an interesting book -- thanks for mentioning it -- but I can't bring myself to feel sorry for someone when their problem is simply that someone else has more material means. Isn't having hot running water and three meals a day more important than to be earning at a certain percentile relative to your neighbors?

But if it is such a big problem, any measure that makes it less severe ought to be welcomed. Thus, reducing the income gap by halving everyone's income would be seen as a step in the right direction, even if better solutions (like increasing the low salaries) exist. The fact that slashing salaries is obviously bad suggests to me that income disparity is not so very evil. As far as envy goes, as long as people are eating mud I could not care less about someone who feels sad simply because they are not the wealthiest people around. As for the thoughtful web, three cheers.You seem to be arguing that we should fix income disparity

Far from it, I am not convinced that it is a problem that needs to be fixed.You know what I mean. Income disparity is a problem in the sense that poverty is a problem.

Poverty is a problem, I get that. What is the connection to income disparity? Is it your belief that The rich get richer and the poor get poorer?

I think it is likely referring to the long term capital gains rate, which is around 15% currently. That is, what, half of what it was years ago? I don't have the numbers off hand, but it is quite low by historic (since the New Deal) standards. I think this has contributed to wealth aggregation, but it is far from the only problem.· A statement like "taxes on entrepreneurs and investors are already historically low" is too fuzzy to fact-check. Anyone who advertises housecleaning online is an entrepreneuer. Anyone with a 401(k) is an investor.

But this guy's point is that the rich are getting off easy. Don't plenty of people in the bottom 90% pay capital gains taxes? The Tampa Bay Times makes it look like the answer might be no. But 14.3 million is also many more people than 1.8 million. I guess it depends on what point one wants to make.I think it is likely referring to the long term capital gains rate

Maybe, but why not say so? If you are making an argument, why not be clear?15% currently. That is, what, half of what it was years ago?

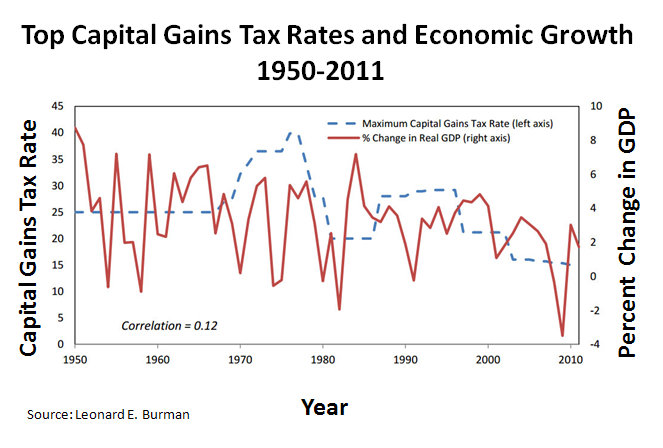

Looks like it has been dropping -- the dashed blue line in this chart:

Among tax filers making $200,000 or less, about 14.3-million of 130.8-million filers reported income subject to capital gains taxes. That's about 11 percent.

Among tax filers making more than $200,000, about 1.8-million of 3.6-million filers reported income subject to capital gains taxes. That's about 51 percent.

When I see the sentence "Income for the bottom 90% declined" it creates an image in my mind. I see a worker who is dejected and beat down in 2007, remembering the higher income they enjoyed back in 1997. But that is not a description of an individual person. The decline is in the average. If you entered the job market earning less than the mean (like most of us did) you pulled the average down a bit at that moment. No big deal!Me!

Good for you!I wasn't employable in 97. I don't know as I count.

You count in my book.