I think it is likely referring to the long term capital gains rate, which is around 15% currently. That is, what, half of what it was years ago? I don't have the numbers off hand, but it is quite low by historic (since the New Deal) standards. I think this has contributed to wealth aggregation, but it is far from the only problem.· A statement like "taxes on entrepreneurs and investors are already historically low" is too fuzzy to fact-check. Anyone who advertises housecleaning online is an entrepreneuer. Anyone with a 401(k) is an investor.

But this guy's point is that the rich are getting off easy. Don't plenty of people in the bottom 90% pay capital gains taxes? The Tampa Bay Times makes it look like the answer might be no. But 14.3 million is also many more people than 1.8 million. I guess it depends on what point one wants to make.I think it is likely referring to the long term capital gains rate

Maybe, but why not say so? If you are making an argument, why not be clear?15% currently. That is, what, half of what it was years ago?

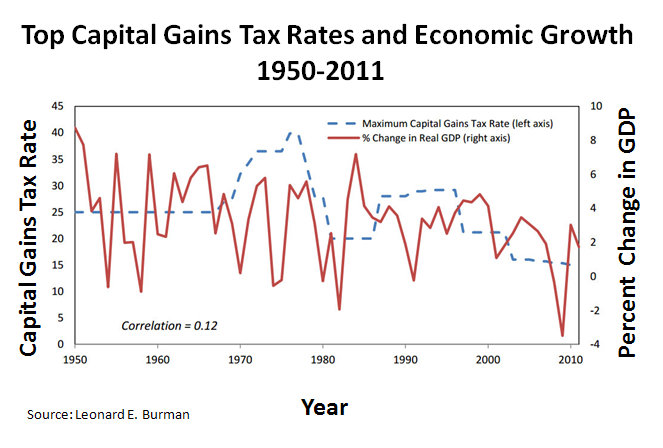

Looks like it has been dropping -- the dashed blue line in this chart:

Among tax filers making $200,000 or less, about 14.3-million of 130.8-million filers reported income subject to capital gains taxes. That's about 11 percent.

Among tax filers making more than $200,000, about 1.8-million of 3.6-million filers reported income subject to capital gains taxes. That's about 51 percent.