So, Ripple has blown up. I very carefully didn't invest in any back when it was 17 cents because I noticed

A) it's not a crowd thing - it's the tokens of a single company

B) there's a set number of tokens

C) it's delineated in Yen, basically - there's 38.7 Billion ripple out there, and that's what it's gonna be. By comparison, the asymptote Bitcoin is supposed to approach is 21 million bitcoins.

However, the market is now insane and nobody has gotten as far as looking at (A), (B) or (C) and as such, Ripple is trading at something ridiculous like $2.60 each (at this moment). And shit - there aren't actually 38.7 billion XRP, there's 100 billion XRP and Ripple owns 61.3 billion of them. Which if they ever cashed out would be worth a shit-ton of money. Or would it crash the whole network?

____________________________________________

According to the St. Louis Fed, the "informal economy" accounts for 13% of the GDP of developed nations and 36% of developing nations.

According to the CIA, the "Gross World Product" is $107 trillion. The World Bank puts it at 78 trillion. If 3/4ths of that is the developed world, that's 58 trillion, or a 6 trillion dollar black market. If 1/4 of that is the developing world, that's 20 trillion, or another 6 trillion dollar black market. 78 trillion plus 12 trillion is 90 trillion, not 107 trillion, but hey we're talking about trillions which is nuts enough (6 trillion dollars is more than 18 F-35s!) but let's call it 12 trillion dollars to have a number.

Presume the sole purpose of Bitcoin is to transact off the record. It is solely a marker for black market transactions. If 10% of all black market transactions were to transact in BTC, and all 21 million BTC were used to do that transacting, then 1 BTC has a nominal value of $28,000. If 100% of all black market transactions, 1 BTC has a nominal value of $285,000. At a circulating supply of 17 million BTC, worth $15,000 each, bitcoin only has the capacity to cover 2% of the black market.

I have no idea what I'm talking about. But then, that puts me in good company when discussing crypto. Somebody shoot me down - because I think I just argued myself into believing that the "top" in crypto has a ways to go.

I wouldn’t touch Ripple with a 10’ pole. No one ‘investing’ in it is looking beyond the price. As for the black market, btc may be losing its edge: https://www.bloomberg.com/news/articles/2018-01-02/criminal-underworld-is-dropping-bitcoin-for-another-currency Bloomberg failed to mention that btc is also very expensive and slow. Making bitcoin transactions is eye-opening. I suggest anyone that owns (“owns” if it’s on an exchange) btc to try a genuine transaction.

Especially as our villain is gonna be sitting there for days. 3564 minutes. If he initiated his transfer New Year's Eve, he's getting his coffee at 10:30 tomorrow.Say, for example, a coffee shop in Berkeley is known to have a certain bitcoin address, and a wallet used by an extortionist transfers the same amount there every morning at 9 a.m. Police can stop by and make an arrest.

I think Ripple is rising fast is because people understand it. They look at Bitcoin and think why? I'll use a credit card. They look at ether and ask if they really need to buy a cryptokitty. Huh. But Ripple is going to be used by banks, to send money fast and save the banks 60% in fees. (As I understand it, a bank need to have an agreement with another banks for transfers between currencies and both need fiat locked up just for transfers. This keeps a lot of banks' money off the table, just for transfers and conversions. Ripple could eliminate this need.) That makes Ripple very understandable to people who have money and so they buy buy buy. Yeah, there's too many of them, but what will the crash point be and what will the final price bewhen it all settles? 10 cents? $1? $10? I don't even know how to think about it. I do know I bought some last summer, made a huge return, and sold out most of it week.

I think you're right, and it's discouraging. "Why bitcoin? I'll use a credit card." - Because bitcoin isn't a credit card, bitcoin is a less-traceable, more portable sink of value for people attempting to shelter earnings. "They look at ether and ask if they really need to buy a cryptokitty." Without recognizing that cryptokitties are derivatives and that investors trade in derivatives all day long. On the face of it yeah, it's stupid as hell but I guess the market cap of Dogecoin crossed a billion dollars yesterday. Ripple? Yeah, it's a marker for banks to talk to other banks. Except the banks already have Hyperledger. And they already have fractional reserve banking. And they already have the ACH settlement network. But primarily, it's a lower number. My cousin told me he wasn't investing in Ether or Bitcoin because "he didn't have that much money to spend." At a certain level, we've got speculators that don't even understand you can buy fractionally.I think Ripple is rising fast is because people understand it.

I'm talking about regular mom and pop folk. They don't "get" bitcoin - they're not looking to shelter earnings. And yeah cryptokitties are ridiculous, but I find it to be an encouraging development anyways. It's hard to explain to folks the value of ethereum, but when we get a wave of dapps rolling in, this year I hope, ether is going to be hot. Kitties is the first strike. And while I think kitties are a joke, when I showed them to my gf and my son, my gf said right away "We should buy some! These could be really valuable!" And my 17 year old immediately began downloading metamask so he could start the buying process. Luckily hehas no ether, but I did think about putting him in charge of kittie breeding 'cause he lives in this world of online gaming and is damn good at this kind of thing.

It's not, though. It's just that nobody does. The value of Ethereum is that it's the native currency for a globally-distributed financial machine that can do most of the automated transactions and interactions of the Internet without any central control or chokepoints. Ethereum is what makes a global information framework run, and it takes Ethereum to make that framework run fairly. If you say that Ethereum allows for an Internet that everyone can interact with, transact with or profit from without interference simply by having a connection, you've got it. That's it. Right there. But nobody bothers to explain it that way. Nobody wants to explain why the hell the root word is "cryptography." Nobody wants to use the word "distributed." Instead they go "look - a fake cat is worth a hundred thousand dollars, therefore buy ether." At least Beanie Babies were soft. Yeah, mom'n'pop folk (or more accurately, their driving-for-Uber children) don't "get" bitcoin because nobody has bothered with the fundamentals since before it was $100. This is why every traditional investment manager under the sun barks "Tulip crisis!" in a Pavlovian fashion whenever you say "crypto" or "bitcoin." I read a great quote from Eric Schmidt this morning: People think they understand the Internet. My beef is they have no interest in understanding crypto, but they're all eager to buy some. It's hard to explain to folks the value of ethereum

The Internet is the first thing that humanity has built that humanity doesn't understand, the largest experiment in anarchy that we have ever had.

All roads lead to veen There are a number of nerdy pages listing "use cases" and the like but there's a lot of blind men & elephants. Fundamentally, if it can be done on the internet, with a bank, or involving programming (or all three)it can be done on Ethereum instead of on the internet, with a bank or with programming which means the sky's the limit. Examples I've used include AirBnB - the EVM knows the MAC address of your phone and my smart lock so when you walk up my driveway it escrows $500 and withdraws $100 from your wallet and unlocks my door, then it releases that $500 when I verify you didn't trash my house. You can use transit - My MAC pops up on the network at Union Station and because I've got a contract with LA Metro the turnstile opens. Then when it shows up at Hollywood & Highland it deducts $1.75. I find it's easier to come up with examples on the fly than point at something mythical on the horizon. It makes things far more relatable.

I don't think they have any interest in understanding fiat or general finance either. If we went and polled 100 Americans and asked them what the Federal Reserve was, what sort of answers do you think we would get back?My beef is they have no interest in understanding crypto,

You're not wrong, but "money" is an easy concept to wrap your head around from a utilitarian standpoint: "It's a marker I can exchange with people because the government says so." Equities are equally so: "my ownership of this stock means I own a fraction of that company." Try that with Bitcoin: "it's a marker I can exchange with people because there's a vast consensus network that keeps track minute-by-minute who has how much for everyone in the world via unbreakable codes." That's the stumbling point for cryptocurrency in general. You need to be comfortable with the concept above before you can consider the vagaries of one coin over another. And then of course you look like a damn fool because the fundamental value of these coins depends on their adoption and utility and nearly all of it is locked up in exchanges like some damn non-dividend-paying stock. 78 days ago, I pointed out that the market cap of all cryptocurrencies was a mere $174b. We're at $816b right now. We're up like 5x in 11 weeks. That represents real, physical money pouring into crypto, pushing it up to shouting distance from Apple's market cap. If Apple didn't exist yesterday, but did exist today, it would take a lot more than three months for Apple to be worth $900b. So whether or not people understand equities, they have a latent familiarity with their behavior that tempers their enthusiasm. The crypto market does not provide latent familiarity but a whole bunch of people don't care.

Dude I just don't know what else to say. When I write communications for release to the general public I have to put each and every word through a vocabulary checker that limits me to 6th grade level words. Except that's insulting to 6th graders because they are more likely to understand vaguely how blockchains work than the average adult. You can't make people care about financial theory. You can't make people care about cryptographic theory and hash rates and the marginal utility of one blockchain over another. There is a techno-literate elite in this world who invents things. There is a sub-class of paritally literate techpriests and engineseers who keep it running. Then there is everyone else who shits themselves in terror if you ask them to open the back of their phone and put in an SD card so that they have enough space to download Candy Crush Saga Legends: Triple Fire Emoji Plus for the fifth time. I don't have a solution in mind that is workable. I don't think anyone else does either. None of the badfeels associated with the most recent crypto-bubble have anything to do with the tech. It's entirely related to how people relate to and interact with the technology. At some point we are going to have to, as a species, come up with a way to train children to be tech-literate and tech-responsible and even then there are gonna be obstacles and harm. Cars are safer than ever and tens of thousands of people still die because they don't use their seatbelts or somebody drives drunk. I guarantee the dirt-squatting quarter-ape who invented fire burned themselves, and likely the early-adopters of that era did the same. The challenge for me at this stage of the game is how to relate to the tech-illiterate in a non-shitty way. The instinct is to just feel smugly superior that I have a vague notion of how computers work but I want to try and think that we are capable of something more nuanced and productive than a modern caste system.

Your communications aren't intended for self-assured speculators that wish to make money by out-thinking the crowd. You're right - you can't make people think about financial theory. I'm not saying everybody needs to eat their vegetables. I'm arguing that a horrifying fraction of those in the crypto space are perfectly okay with their ignorance, and that ignorance leads to distortions. I can point to the reasons valuations are high in the stock market. Institutions have targets to meet and with no good options, they have to make it work with the bad. But crypto is pure speculation done on exchanges with no regulation or guarantee so that's all elective greed. I know how badly you want to gutterball this discussion into one or the other of your threadbare, time-worn "all humans are bad" tracks but it's simply not the case.

Trying to do the opposite actually. What is the way forward? How do you keep greedy dummies out of crypto until it's more useful? Is keeping greedy dummies out of crypto a good thing in and of itself? Or does this just end with a lot of greedy dummies getting burned?I know how badly you want to gutterball this discussion into one or the other of your threadbare, time-worn "all humans are bad" tracks

This whole conversation reminds me of when AOL provided a link to the World Wide Web for their subscribers. It was the first time that "browsers" - aka, people who browse, but do not produce content themselves - were allowed onto the web in large numbers. It instantly flipped the entire web from a place where creative people built shit and shared it with each other, to an enormous horde of people consuming/copying/commenting on your stuff. Which was useless. These people were using the Web like TV, rather than the hot rod auto shop that it was. What the fuck do I care what some non-creator from Poughkeepsie thinks of my work? What have THEY done? Bitcoin, et al, seem to be in a similar place: A great tech idea was just about to hit its stride and become something much bigger and more powerful... and then the looky-lous came in, and have artificially skewed the idea/product/technology. From someone who has lived through this change four times: It ain't coming back. It is now the property of the speculators. They are there, they are in, and you cannot eject them. They are now a fact of the market, and just need to be endured and understood. (Incidentally, this is why I don't play PubG, a game I know I would love. It is over-populated with people who are REALLY GOOD, and snipe any newcomers constantly, until it is no fun. This creates an isolated cadre of the "elite" who play it until the company can no longer sustain the server costs, and goes out of business or sells off to someone else, because they can't get new users to play.)

No, not like that. The discussion is not "you guys are polluting my internetz with your triviality" it's "Just because you can buy a GSXR does not mean you should see how fast you can take the Angeles Crest." Or worse, "just because you can walk through a dark alley with fistfuls of cash doesn't mean you should." OftenBen's argument is "people are stupid, let them eat shit." My argument is that "protections exist for stupid people and a lot of them are going to get hurt." It's not far from this: Really, though, that's a subsection of a larger discussion about where the "top" would be, if we could try and figure out the top. I don't think we can. In the meantime though there's now real money piling in which increases the target richness in the ecosystem. The statement that sent OB down the hate spiral: They don't understand the Internet either. You know that, I know that, we all know that. But "the Internet" has a lot more protections and familiarity than cryptocurrency does. I transferred 50 ETH yesterday. That used to be cute. That used to be, like, $35. You copy-paste a number like 0xC2D7CF95645D33006175B78989035C7c9061d3F9 And you copy paste a number like 3a1076bf45ab87712ad64ccb3b10217737f7faacbf2872e88fdd9a537d8fe266 And you hit go And you hope to shit it's right And in 30 seconds or so the money goes from one place to another. $35! Super-awesome! 30 seconds! Future of the Internet! Except it's not $35, it's a goddamn Mercedes E-class that you could lose because of a typo and you can cry to whoever you want, the blockchain don't care. And right now we're all fuckin' around trading in exchanges and maybe that's the future but the kind of naked risk you're exposed to with this shit is something we haven't seen since we chased the brigands off the turnpike.People think they understand the Internet. My beef is they have no interest in understanding crypto, but they're all eager to buy some.

The way forward is to watch and try not to get hurt.

One wonders if beanie babies happened today if we'd see daily Direxion 3X jerry garcia bull ETF shares. And if Wall Street would think that was a good idea. And if the internet would be full of smug beanie baby "investors" who think that they're the only ones who really understand how cute the babies are and everyone else is a moron who doesn't even know how thread is spun so why are you even investing leave the investing to those of us who really appreciate fine polyester.

To phrase my initial curiosity more directly: Why do you have beef with people who don't have the capacity to understand what your beef is about? I can ask myself a similar question about unrelated topics; religion being the one most present in my mind at the time.

I get the same reaction as your cousin's often -- in fact just last night I had a friend say he couldn't afford to buy one ether right now. No matter how many times you say it some people, they think they have to buy ether or btc in whole units. These low prices on some coins are very encouraging for people just coming in. And if we're interested in quick investments they become interesting to us for this same reason.

There was someone at the Coinbase Christmas party who heard that they were discussing adding Ripple to Coinbase. I've heard people say that that rumour spread like wildfire and caused the current rise. TRX seems to be even more speculative. I really would not be surprised if less than 1% of investors goes beyond the landing page of a token's site, let alone read a whitepaper. Do "investors" really know about projects beyond some soundbites?"They look at ether and ask if they really need to buy a cryptokitty."

Here's where it gets awful: There's nothing preventing you from 1) Buying a bunch of Ripple 2) Posting on Reddit that you heard a rumor from a friend who has a friend who went to the Coinbase Christmas party who said he overheard they were thinking of adding Ripple to Coinbase 3) Wait 12 hours 4) Sell a shit-ton of Ripple at a hilarious profit Or worse 1) Be coinbase 2) Buy a shitload of Ripple 3) Leak that you're thinking of adding Ripple 4) Sell a shitload of Ripple Or worse 1) Be Ripple 2) Tweet that a picture of Coinbase's logo 3) profit The average stock market investor is unsophisticated. However, he's investing in something protected by securities exchange commissions, however paper-thin those protections are in actuality. Crypto speculators? that shit is all hanging out.

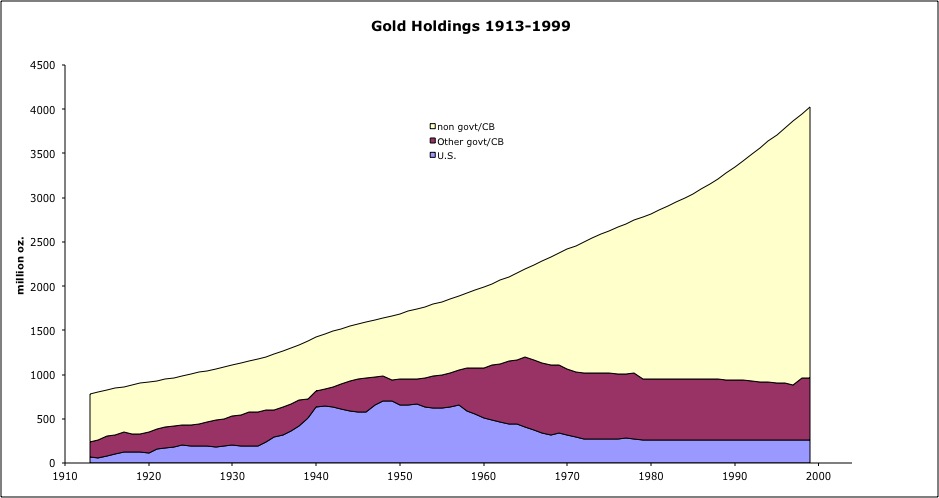

I've wondered to what degree Bitcoin's value is actually based largely on "tax evasion for everyone", and not on all the things crypto nerds dream about. I have lost all faith in it ever being a transactional currency. While I don't really understand the whole "store of value" debate, I do see Bitcoin as gold that you can transfer within a day to anyone. Taking a $6 trillion estimation of the gold market, Bitcoin could reach almost $400,000 just to be equivalent to gold. Even if you take a more conservative $2 trillion, that's still a lot of room for growth.

Gold is a curious one, too. Not adjusted for inflation and the gross world product does something similar: https://media.treehugger.com/assets/images/2012/02/indicator2_2012_gwp.PNG Gold has a use, though. Most of that which is mined is used industrially and commercially which takes it out of circulation as a marker of value. Looks like half to two thirds of gold is used in jewelry, for example. Still puts that number hella higher than it is now.

The best way to think of Ethereum is as a preinvestment in runtime on a globally-distributed mainframe. At the end of the day, all any of us have is energy and time and it takes time and energy to execute commands on this network, which takes time. Ether is the unit that measures that energy on the Ethereum "machine." Strictly speaking, Ether is one of the only cryptocurrencies that has a non-zero intrinsic value. That intrinsic value is directly related to the utility of the machine running it.

There are five possible use cases for crypto that I see. 1. A black market currency 2. A low-fee, decentralized international payment system 3. An investment 4. A general-purpose currency 5. A secure, trustless information ledger As A Black Market Currency For use in the black market, we're going to want a way to hold the currency anonymously, and a way to send private transactions. - BTC wallet anonymity is possible with a few hoop jumps, but private transactions are impossible. If address X has a transaction with a known black market address, this is public knowledge, and address X is forever associated with this shady exchange. - XRP has the same problems as BTC, with the added risk of validators simply rejecting transactions with known shady addresses. - ETH is currently no better than BTC, but they plan to implement technology borrowed from ZCash to allow private transactions, so ETH will be more private in the future. Best alternatives right now for this use case: Monero, ZCash As An International Money Transfer System For this, any low-fee system will work. The lower the fees, the better. Right now this means everything but BTC, but what would the fees look like in the future, assuming widespread adoption? - BTC "on-chain" transactions will only get worse, but they are working to implement Lightning Network. This will end up sort of like a "real" BTC wallet that you treat like a savings account, and a Lightning BTC wallet that you treat like a checking account that has low fees and fast transactions. The catch is that you have to pay the on-chain tx fee to transfer from your BTC wallet to your Lightning wallet. - Same story for ETH, really. Widespread adoption of ETH will result in high transaction fees. Not as high as BTC, but high. Ethereum is working on several scaling strategies in parallel, but realistically they're a year or two away. - XRP was built for this use case. It will scale, be low fee, and in the future, it may even be possible to use it through your bank. It's not super decentralized, but it's fast and low fee. As An Investment At this point I have no idea. I don't understand why the market caps on these coins are so high. Let's be honest, they don't do anything cool yet. As a general rule I'd say don't put in anything you can't afford to lose 100% of. In the long term, I think any cryptocurrency that has a capped supply and a plan for scaling is a decent choice. I personally like the smart contract ones: Ethereum, Zilliqa, Eos, Cardano, RChain. Raiblocks is cool too. There are also some interesting ERC20 tokens. But those are all just opinions. As A General Purpose Currency For this use, we want widespread adoption, stable value, low transaction fees, and transaction verifiability. For this space, my favorite is USD. Seriously though, a deflationary general purpose currency makes a bad currency, and so does a volatile one. Imagine buying something on credit and owing waaay more than you thought you would, or buying something when you could have bought two of it a month later. Deflation and volatility decrease the money velocity of a given cryptocurrency to the point that any economy based on it is much smaller that it would be otherwise. It makes the currency hard to spend and discourages its use. We already see the effects of this: Very very few businesses accept BTC directly because its value is so unstable. And it's a vicious cycle; less businesses accept it, so its utility is less, so less businesses accept it. In the long term, I think something like Dai or OmiseGO has a chance of being useful. But it's not ready yet. As A Secure, Trustless Information Ledger This is the space that I think has been explored the least, and which I think has the post potential. It could disrupt a lot of industries, including certificate authorities, DNS, and, maybe someday, thinks like deeds, titles, stock ownership, and land registries. But all of this is years off. - BTC and XRP cannot be used well for this purpose. - ETH was built for this use case. Maybe in a few decades we'll see corruption in some countries being combated by registering things in an Ethereum or Ethereum-style blockchain.

I usually have no idea what I am talking about either, but given this is rumination.... Reading around it seems a lot of analysts are taking the same approach. There is some debate around the velocity of Bitcoin (how many transactions in a year would a single unit account for). Interestingly many pundits are suggesting Bitcoin should be measured with a velocity of ten, which is similar to hard cash in many cases. Velocity of 10 * 21 million BTC asymptote gets 210million transactions per year or $3tn at current valuation.

I believe that Ripple rising up so much is also due to the fact that new comers see it as "being cheap", in the sense that it was only 1$ to own a coin a week or so ago. Other people analyzing that new comers would see it this way, they wanted to make some quick money analyzing the sentiment of the crowd and went in: Self-fulfilling prophecy. I would not invest in Ripple now. I don't own any. I used it to cash-out $50 because it was the cheapest & fastest option (I wanted to see how cheap/fast I could cash-out). But then again, who knows what it will be worth in 1 month. I never thought the black market would be this big. What you write makes me want to double down on one of my bet. There is this coin, Zclassic, that is going to transform into BTCP (Bitcoin Private), where each owner of Zclassic and each owner of BTC will receive 1 BTCP. So owning 1 Zclassic now is like predicting the price of Bitcoin Private if everything go as planned. The fork is supposed to happen before february. It's risky, but the market seems so big that maybe there is place for a new player.

One trend we're seeing a lot of is regulation. China clamped down, Korea is threatening to clamp down... those of us in NY and WA are already dealing with this; if you want to trade crypto, you have to trade in a house that's FDIC insured. It has to act like a bank, look like a bank, be regulated like a bank and have reserves like a bank. That means Gemini. And Gemini deals in BTC and ETH, and that's it. There may be other firms willing to step up to the requirements necessary but as other states clamp down on crypto (which they will do, the first time anybody loses their home or some shit because of speculating on BTC futures), it's gonna close out a lot of the weirder coins. One thing about BTC and ETH - it's not that hard to move around without an exchange. But for everything else, it's gonna be exchange exchange exchange. Even now most of the transactions aren't wallet-to-wallet, they're internal exchange.

That's right - I forgot they were okay to trade because my experience with them has been so bad. Just logged in for the first time in like a year and that neglible little bit of BTC I left in there 'cuz it didn't matter is now worth over $100. Crazy times.