Wiping out 10k in student debt is not the most expensive part of the Biden student loan program. Most Federal student loans are now eligible for an income based repayment plan, under these plans students pay a small percentage of their “discretionary” income, say 10%, and then after a fixed number of years the debt is wiped off the student’s books. At first glance these plans don’t seem crazy, but as Matt Bruenig points out they create perverse incentives.

The IDR changes are four-fold: Increase the amount of income not subject to IDR from 150 percent of the federal poverty line to 225 percent of the federal poverty line. Reduce the interest rate on IDR-enrolled loans to 0 percent.

For undergraduate debt, reduce the IDR rate from 10 percent of income beyond the threshold in (1) to 5 percent of income beyond the threshold in (1).

For IDR-enrolled debts with original loan balances below $12,000, reduce the repayment period from 20 years to 10 years.

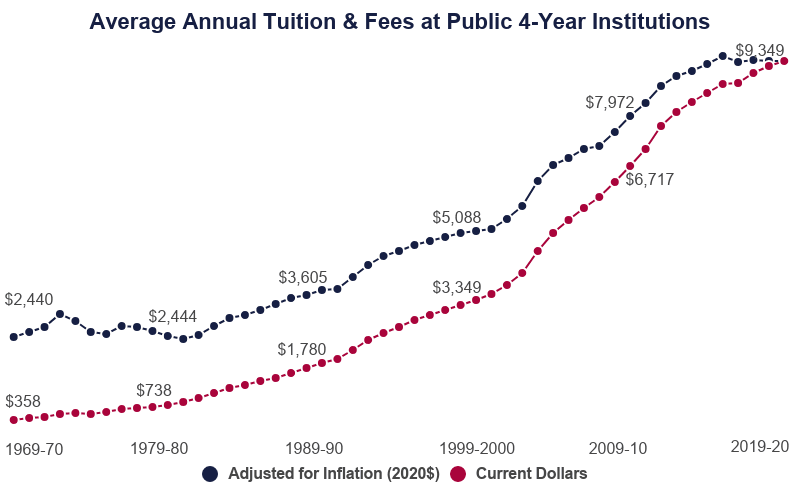

The cart-horse fallacy here is strong. All federal student loans have been eligible for income-based repayment since 2009. All federal student loans have also been eligible for infinite deferral, too. That whole Snidely Whiplash "hey law student I'll raise my rates but it won't matter because you'll never pay it" thing is an utter ruse, too, as student loan balances are absolutely used in calculating credit risk. The "public sector" canard is thin AF, too. We've been trying to qualify for that for a good six years now - but in order to qualify our employees we have to serve at least 35% medicaid clients. We've been at 29%-33% since we opened and to qualify your facility has to be certified, and as best as we can figure out nobody has accomplished that without being sited on a Native American reservation. Sure - you can work for the government but then this Is revealed to be the fairy tale it is. Contractors aren't eligible - trust me, I know several. You have to be ass-in-chair working for the government for ten years and I have yet to meet anyone who has done that (and I used to consult about 80% on government projects and interact about 80% with government employees). And $150k a year is like "be an assistant coach on a Big 10 football team" money. For example. Finally, most of the reforms within the plan affect bachelor's degrees only. There's no cap on advanced degrees. So that magic $150k a year job is for... what exactly? Not a lawyer. Pharmacist, maybe? "Government pharmacist" is a pretty narrow profession. The 10% cap applies to undergrad; the 15% cap for graduate degrees is unchanged. But let's take the whole argument as if it were being made (A) in 2009, when income-based repayment was first instituted or (B) in 1978, when it became illegal to disburse tuition debt in bankruptcy: I dunno, chief. The former is from $8k to $9k. The latter is from $2k to $8k. Somehow I don't think income-based repayment is the problem. Prolly more like turning education into an inelastic good with elastic pricing.Suppose a student will make 150k per year for 10 years working in the public sector.

And again for shits and giggles, you can run the numbers on this. Initial loan: $150k Loan term: 10 years Current undergrad interest rate: 4.99% (graduate unsubsidized, 6.54%, graduate PLUS, 7.54%) Pre-existing payment term: 10 years, 120 payments Income: 150k; 10% of income $15k, payment per month, $1250 Undergraduate student loan payment, non-income based: $1590.25 Interest paid: $41k income based theft from all good libertarian capitalists who love their mothers and hate free rides: $340/mo x 120 payments = $41k Even in this magical fucking scenario where our state pharmacist is robbing the country blind, the end price is... the government doesn't make a vig. After ten years our state worker has - wait for it - paid off his principle. Meanwhile he's been paying taxes on $150k a year, which is currently the 24% tax bracket. Let's say before he got his magical pharmacy degree he was... a starbucks barista, pulling down $37k and landing in the 12% bracket. Starbucks taxes: $995 + 12% of ($37k-$9950 = $27050) x 12% = $4241/yr x 10 yrs = $42k Magic state pharmacist taxes: 24% of $150k = $36k/yr x 10 yrs = $360k So. The government gave up $41k in student loan interest and gained $320k in income taxes. it's almost like investing in education is worth the money.

Yeah I don’t agree with his numbers at all. If the graduate makes 150k a year that not really a problem like you just pointed out. Where I see the bad actor problem the university not the student. By running the income based repayment down to 5% from 10% almost +250% poverty line exemption everyone is better off doing income based repayment. That’s good for the student but it completely removes any price sensitivity because even at a state school you basically cap out your income based . Now there really isn’t any difference between getting the 100k loan or the 400k loan. It’s income based repayment for the next 20 years for everyone . Of course in practice the 400k loan will balloon to something like 1m and when it gets forgiven it will get taxes at 35% making it almost a balloon loan so the student still loses but scammy university isn’t going to tell people that they will have gotten paid long ago. They will just Jack up their prices advertise income based repayment and take in the profits shifting costs to taxpayers. The republican concept of “moral hazard” is a real problem it just doesn’t really apply to individual people like republicans say it does. Corporate entities do suffer from moral hazard, as soon as a loophole opens up they rush to exploit it and this is one big loophole

Again, cart before horse. I spent 2000-2005 designing fancy-pants rec centers for universities because they were competing in a market of "who's got the bitchinest dorms" not "whose degree program has the best earning potential and connections." My wife's alma mater is in a real crisis because they can't get anyone to sign up for their ridiculous tuition. Where did they open their branch campus? Torrey Pines, some of the most expensive real estate in the United States. Their expansion plans for the past fifteen years have been directly related to "what can we do to attract more conferences" not "what can we do to attract more students." But hey - let's look at income-based pricing. Average liberal arts starting salary: $42k Average liberal arts cost: $58k Average liberal arts student loan, no IBR: $614/mo, $74k Average liberal arts student loan, IBR: $350/mo, $42k Actual cost to the government: $0 Average CS starting salary: $76k Average CS cost: $52k Average CS student loan, no IBR: $551/mo, $66k Average CS loan, IBR: $633/mo. The loan already costs less than the IBR cap. Here's what this nothingburger really says: income-based repayment means 3rd party payments processors can't profit on underperforming student loans, they can only service them. How is that not an undiluted net good? I mean yeah - allow me to nod in the general direction of your AEI fever dream up there and say "cool story bro" but the whole point of college fucking loans is they increase the earning potential of your citizens thereby increasing your tax base. Skilled labor is more profitable than unskilled labor. Here's a video of Israeli robots picking apples. College is a clusterfuck and a scam, and the only way to maintain any edge in the world economy is to have more college grads. If the Biden administration can best execute a quick fix to the problem by leveraging Republican 9/11 bullshit good on 'em. Anyone who doesn't see that has failed macroeconomics.

In think maybe I’m calculating IBR wrong because under the new formulation I would get way less. Assumed: 76k a year salary with 52k loan 76k-32k (250% poverty line) = 44k ibr value 44k*.05/12=183$ a month. So slightly less than the interest on the loan. And that’s assuming that you didn’t bake in all your housing and other expenses into the loan to get it up well over 100k since ibr has you capped at 180/month

'k, 5%. Let's fucking shoot the moon. Highest room and board is NYU. Tuition is $58k a year. This poor sucka gonna average $34k a year. We're at $304k for that lesbian dance study degree or WTFever but keep in mind - there just aren't that many slots open for this kind of profligate waste. About a hundred undergrads at any given time. $58k plus $18k x 4 = $304k. 120 payments of $3209 gets you free! Or wait, $34k is $3400 is $141/mo is a mere $17k to the government! Holy shit! Those freeloaders are getting away with like $290k! Soon the world will be covered in lesbian dance majors, eager to make Starbucks wages and bilking the government of our hard-earned tax dollars! Sacramento paid $8m for this. That's about 27 Titsch grads. Who pay taxes, drink Starbucks and shop Amazon. A Titsch grad is also about three Excalibur rounds, about four Javelin missiles. A Titsch undergrad education, under the new 5% rules, would pay for about 78 inches of the Bridge to Nowhere or about 19 1/2" of Seattle's light rail expansion. So - is the world suddenly going to be aflood in profligate dance majors? Or do the arts just fucking cost money? You can't draw a normal distribution without drawing extremes. Are there programs that are going to get a boost from loan forgiveness? Undoubtedly. But right now, this hypothetical lesbian dance major at NYU is going from a 15% cap to a 5% cap and a 30-year repayment schedule to a 10% repayment schedule. The government was never seeing their money anyway (maximum payment on that loan was $166k). Enrollment was already down. Here, try this one on for size: I know of two midwifery schools closing. Why? nobody wants to pay the $200k tuition for an average salary of $49k a year. Know what that means? 3 birth centers are closing because they can't hire midwives. Know what that means for the state? It means about 300 fewer births at a cost of $4500, and 300 more births at a cost of $18k, because there aren't six midwives. That's a direct cost to the state Medicaid system of $4m per year for a tuition cost of $1.2m. There's a real "ZOMFG SOMEONE BESIDES ME IS GETTING LARGESSE" about all this student loan bullshit and I'm here to say - your selfishness is showing. Any fucking society with plans to last through the next election subsidizes something and if it isn't you, congratulations, that means your job is tedious enough that you have to get paid directly.

Essentially student loans will all go to income based repayment. That completely removes the caps for tuition fees and allows all sorts of bad behavior to occur similar to whats happening right now in the medical field except worse because the tax payer will cover the short fall. Long term this probably does not matter because executive orders only last as long as the president remains in office, but its going to create some perverse incentives for universities to trap students in even more extreme debt.