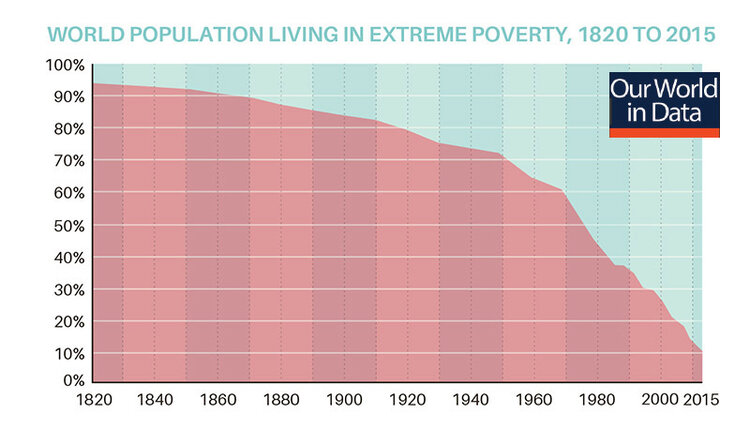

- There’s only one problem: the graph’s long-term trend is empirically baseless. For the period 1981 to the present, it uses World Bank survey data on household consumption. This is a legitimate method for assessing poverty. For the period prior to 1981, however, the graph relies on GDP estimates from Bourguignon and Morrison. The problem is that GDP data cannot legitimately be used to tell us about poverty, because it is not an indicator of livelihoods or provisioning; rather, it is an indicator of commodity production. Unlike the World Bank data, it does not count non-commodity forms of household consumption (subsistence, commons, mutuality, etc.), which was the dominant form of provisioning for most of history.

Hickel expands on this point in his book The Divide. The neoliberal triumphalism of Pinker and Gates seems a little too convenient once you interrogate the data a little.

Roughly a third of Piketty's Capital in the 21st Century is an investigation and analysis of the historical data available on income, expenditures, income equality and accounting prior to the modern record. Piketty makes the point that throughout literature, it was a given that real prices would be included because they never really changed. Jane Austen had every reason to assume that when she was talking about tuppence, people a hundred years in the future would have the same anchor for that tuppence because tuppence had roughly the same buying power a hundred years previously. In fact, the fluctuations of that buying power were used during the medieval and renaissance periods for contemporary economic analysis, just like they are now. However, something flipped after WWII in which prices were no longer included in literature because inflation had become the constant, not pricing. Piketty also dunks on pretty much every Chicago and Austrian economist by pointing out that the data isn't that hard to find if you're willing to look... and that the actual data is wildly divergent from the accepted consensus reality provided by spitballers like Bourguignon and Morrison. He eventually straight up accuses modern economists of modeling the entire world as America 1950-1970. There was a Chase analysis after Hurricane Harvey that had the quip "natural disasters are great for GDP and terrible for the economy." That a bank had to make the distinction between productivity and life says a lot.