- The Federal Reserve, saying “the coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States,” cut interest rates to essentially zero on Sunday and launched a massive $700 billion quantitative easing program to shelter the economy from the effects of the virus.

...

Despite the aggressive move, the market’s initial response was negative. Dow futures pointed to a decline of some 1,000 points at the Wall Street open Monday morning.

My understanding is that bank balance sheets are... fine. This seems preemptory. Furthermore, the problem isn’t a wave of defaults (yet) but broken supply chains, a decrease in the velocity of money, a drop in spending, or a supply side shock.

Matt Yglesias says it’s both a demand and supply side shock, so this may be warranted in his model.

I'm old enough that as a kid, my great uncle Fran used to tell me first hand stories of the Great Depression. My grandfather would walk the railroad tracks as a kid, picking up bits of metal to sell for scrap to get bread. This central banking money system is fucked. Yields have progressively spiked and dropped within lower bounds for the last four decades. Now the bound is near zero. Central banks are pushing on string. That said, the economy is magic. It heals and transforms. People trade, build, and create. IMO in a very real way, what will die off in this next decade needs to die off. It was on life support anyway. My biggest worry is that skyrocketing unemployment will lead to populism, nationalism, and conflict. There's going to be fertile ground for that bullshit. But, as far as the economy goes, I think the world has a real opportunity to rebuild with one that is less top-heavy. I see crypto as a fundamental building block of that. Institutions of trust have been the focus of economic exploits. That's Bernie's whole bang. My prediction is that in the next decade, Central Bank hi-jinks will continue to prove ineffectual at best, and an organic token-based economy will grow parallel to it.

We have been fortunate in that the populist wave hit before the collapse this time rather than after. WWI, the Great Depression and the 30s were all caused by establishment politics. FDR, Hitler, Churchill and Tojo were all reactions to economic failure, not causes. The fundamental problem is that we've all been trading our IOUs at each other for so long that the reckoning when we tear them up is gonna be fierce. That, more than anything, is what normies miss in all this discussion because the financial players obfuscate it: stock markets, bond markets, treasuries, all of it is a wager between "now money" and "later money" and collapses like this happen when people lose confidence in "later money" and want "now money." 2008 was about all the later money tied up in people's mortgages was revealed to be an illusion so people traded whatever fractional later money they had for whatever now money they could get. Now? I mean, Vegas is shut down. Think about that: a city of 2 million people whose only viable industry is entertaining 41 million tourists a year. Multiply by the whole world. Nobody has a good model of what "later money" even looks like.

Yeah he dropped a half trillion in stimulus and shot the last bullets in the gun and the futures market went limit down in fifteen minutes. Balance sheets are fine but thanks to fractional reserve banking there's only enough cash to cover 5% of what's out there and right now treasuries aren't trading. Nobody wants to buy your shitty debt because they don't think it's worth anything.

And they also eliminated reserve requirements--dropped them to zero--for thousands of commercial banks. Not sure if that includes the big ones, but in an effort to boost spending, the Fed is pushing banks to have nothing in reserve. That seems cross-purposes to long or even medium-term solvency. That 5% cash to cover what's out will now drop to... near-zero? Or will banks bulk up on reserves so actually increase?

The problem is the Fed has one tool - liquidity. We've got something structural here. Lots of us have been harping about the structural problems for a long time and the Fed can even agree - it doesn't change the fact that the only solution they have is pouring money on it.

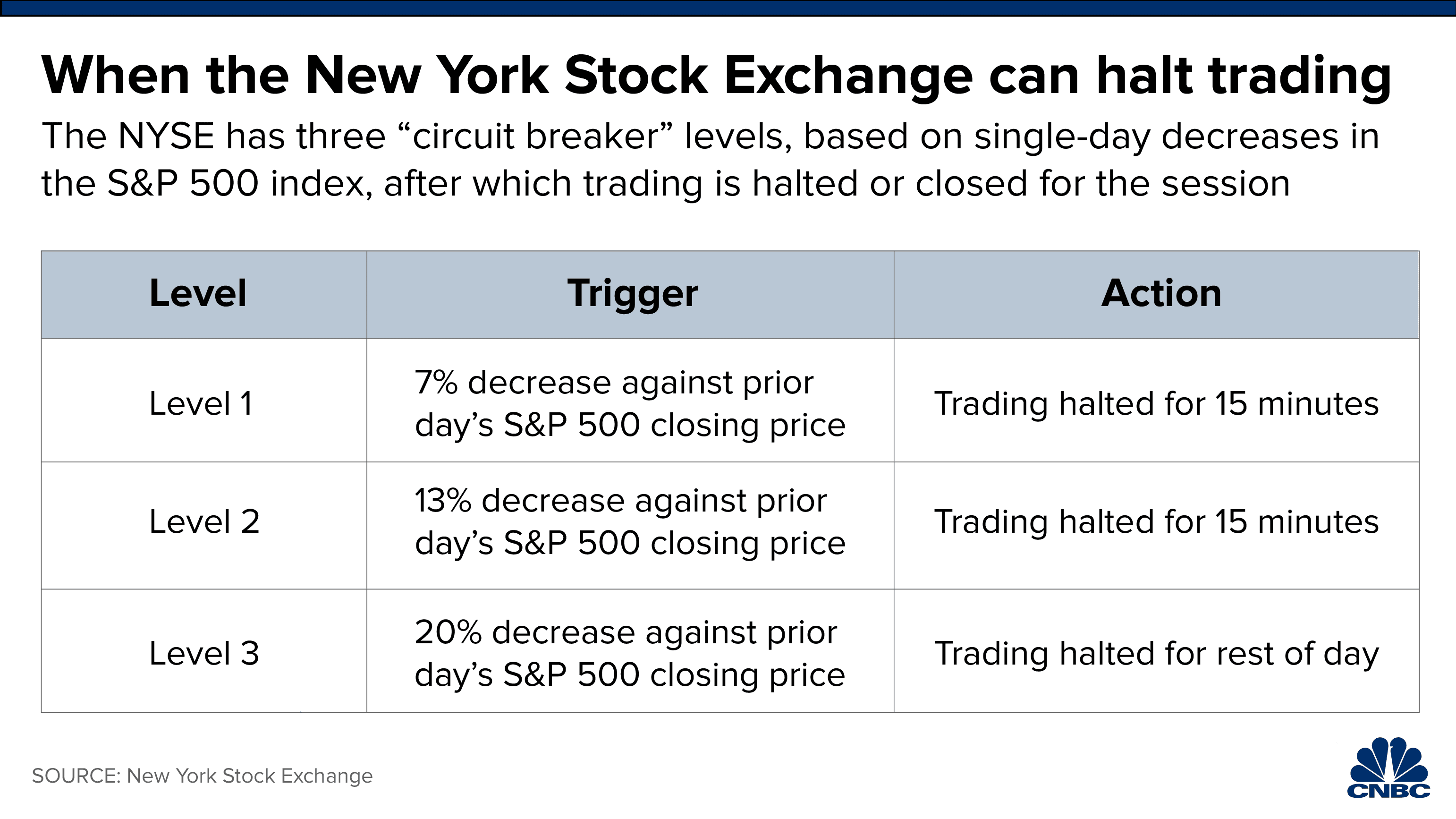

Any bets on how many times the NYSE "circuit breaker" flips and suspends trading today?

We are in totally uncharted territory, and exactly no one can be certain of the optimal set of actions to take. Scary, I know, but I think eventually, this will transform society for the better. Why does it always seem to take a tragedy? :(

Ha! No. Just look at what has happened to the working class poor in America since 2008. Between absolute destruction of job security and legal protections to market speculation increasing cost of living from housing to healthcare, they've been screwed hard. Every year has been worse since the last and I have zero doubts that after this crash, the trend will not only continue, but accelerate. This is why I keep fretting about the market, not because I'm afraid of the recession, but because I'm afraid of what comes after. We're not forced to address our flaws in times of well being, we feel complacent and secure. It's not until things get difficult that we look at things in a different light. Wanna know the awful truth? The people in power yesterday and today, the ones responsible for all of this, they'll continue to be in power tomorrow. When the dust settles, they'll reshuffle the deck, deal out the cards, take a look at everyone's hands, and find a way to write new rules in their favor. All guys like you and I can do is find ways to keep doing good things for the world, no matter what the new rules are.but I think eventually, this will transform society for the better