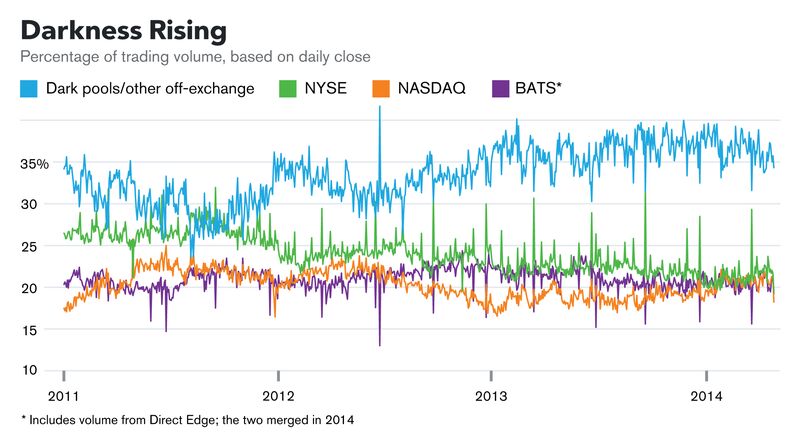

ARMs scare me on principle, but I cannot make a rational argument that interest rates are going to be rising any time soon. I don't even really remember the '70s; really, I would say if it's working for you keep on keepin' on. I understand that ARMs are the norm in Canada. If you have ready cash in the 401(k) and an interest in keeping things agile, I've been rolling over 90-day CDs. It allows me to make a little cash with zero risk while also saying "well I don't think I'll need to buy anything for three months, anyway" and then forgetting about it. Your bot is on point. 85% of trades in the public market are bots... but we don't even know about the dark pools. You know what calms people down? The Run Lola Run soundtrack. So let's use that to look at 500 milliseconds of dark pool trading... in a single stock... in a single dark pool... in 2011. Rhetorical question: what real world information could they act on if they had the ability? Those are bots making three and four bid/ask combos per millisecond. How much do you think the inherent value of any given equity changes in 0.001s?