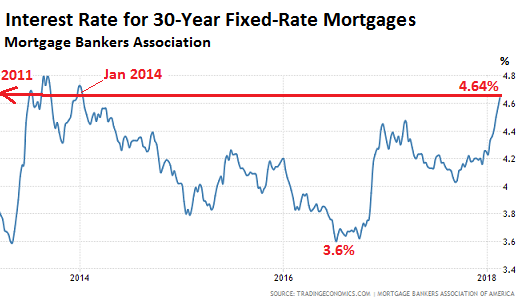

A few fun facts: 1) Seattle is down 7% just for September. In August, prices year-over-year were up 15%. Redfin is now saying prices are up 7% year-over-year. 2) Mortgage rates are up 1.2 points since this time last year. Which doesn't seem like a lot until you realize that's like a 25% increase. 300 grand at 3.4 is $1330 a month for 30 years, or $488k. 300 grand at 4.6 is $1550 a month for 30 years, or $553k. For the payment to stay the same you need to borrow 40,000 less dollars.

2010...jesus. So, is this a correlation =/= causation situation regarding interest rate increases and decreases in home listing prices?

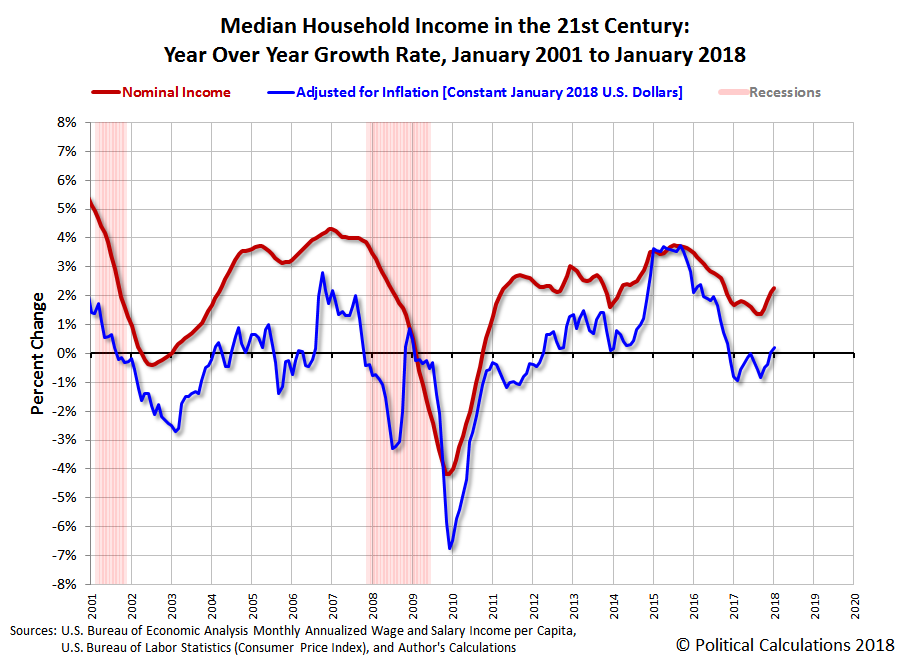

... Most of the hard-core, die-hard financial talking heads will point out that the one predictable characteristic of any trend is reversion to the mean. Basically, if the economy is up, it will go down. Of course when they say it they use graphs and charts and coefficients and sound hella smart and charge you $1500/mo for their newsletter but fundamentally, the argument is the sun also sets. Now you could argue that if the market continues to go up it's a sign that we didn't really know what the mean was and people do. But check this out: You may have heard the phrase "quantitative easing." You might have even heard the acronyms "QE2" and "QE3." That was the Bernancke fed basically buying everything in sight so that the economy had money. You can see the effects of "buying everything in sight" on this graph between 2008 and 2014. In effect, the US government became the customer of anything and everything for sale because if nobody's buying, nobody's selling and we descend into a mire of bread lines and Woody Guthrie songs. If you look at that graph you notice that things are optimistically tapering off into the future. This is the Fed announcing that the problem is solved, time to sell that shit back into the market. This implies that they think the market is strong enough to buy up three trillion dollars worth of assets. Only hang on. See those four squares? That's the Fed telegraphing "OH SWEET HOLY SHIT WE'D LIKE TO RAISE INTEREST RATES PLEASE." They do this because when the rates are at rock-bottom, they can't lower them. And if they can't lower them, they can't attract business by making money crazy cheap. And money has been crazy cheap. Want your stock to be expensive? Borrow cheap money and buy it back. now there are fewer shares and people have to pay more for them. So fundamentally, the government poured money into the economy to keep it running. It's sort of running now. But the government would (A) like interest rates to be back to normal (B) not own a large portion of the economy so it's tightening things. We've got a new Fed chairman - Jerome Powell - who has said that recessions are a normal part of the business cycle. They're basically telegraphing "hold onto your butts." But then, they did the exact same thing in 1929.