"Yes" and "kinda" respectively, if you don't mind turning avocado toast into a proxy for "not in a distant suburban wasteland.

- Millennials are buying homes. Never mind the punditry that the plastic straw-hating snowflakes are stuck in overpriced apartments because they keep opening their wallets for $7 avocado toast. They made up 34 percent of American home buyers in 2017, more than any other age group, according to the National Association of Realtors.

…

Buzzard's home — his first, as it took longer than expected to save the money to buy — was a new build, rare for buyers of his generation. It was in his price range and close to his and his girlfriend's jobs, which he said were must-haves for the new digs. And it's in Kessler, an area near to the bars and culture of Bishop Arts and downtown.

…

"They're pretty particular," Barrios said. "They want a good price, something that's eco-friendly and something that's recently updated. You know, it's instant gratification. We all work a lot, so we don't have the time to do a renovation when we buy." … "We're not doing golf courses anymore, we're doing food and beverage," Ruggeri said.

…

Checking all these boxes requires a lot of research, a natural instinct for people who grew up both on the internet and in the shadow of the housing crisis. It's the main difference between them and their parents, who generally bought at younger ages and relied on realtors more.

The members of Gen Y are wise to be careful.

Even though almost all millennials want to own a home at some point, only a quarter actually do right now, far fewer than previous sets of young adults. They're saddled with unprecedented student loan debt, fast-appreciating rent payments and other debts, like car loans and lines of credit, all of which make it hard to cobble together the money for down payments. And in a supply-starved, increasingly pricey market like Dallas, it can be hard to beat out better-established buyers who put up the cash necessary to close the deal.

The other thing about Dallas -- it is now on a list of markets which are flat or falling (Texas is very well represented).

https://www.trulia.com/research/10-markets-prices-falling/

But it is heavily skewed by price. I saw but can't find anymore a chart of time-on-market by price, and everything under 300k is still super hot. This has some info: statewide months of inventory are rising overall but MOI 200k-300k is rising very slowly and <200k is actually falling. And the Dallas days-on-market average is 43 days.

I have two friends who bought houses in the farther cheaper suburbs, because they have jobs near those far suburbs. I have only one friend my age who bought a house Inside the metroplex. For six months he visited every house he could that met his criteria the day it went on the market, made offers on any that looked good, and got calls the same night or next morning that it was sold to a higher offer and off the market. And then he saw his parent's neighbors getting ready to move, got them to show him the house, and made them an offer before they even listed it. The one millennial I know who bought a house not in a distant suburb, had to get lucky enough to have an inside-connection with the seller and convinced them not to even put it on the market. DOM for anything <250k and in livable condition in commutable distance is about 1/2.

The question the article asks and answers is "are millennials buying houses?" The question that matters is "are millennials buying more or fewer houses than other cohorts at their age?" The answer is "fewer." The data is collected by the National Association of Realtors, and then analyzed locally; I haven't been able to find a national source but here's California:

The pickiness point struck out to me, it makes sense that a cohort with house ownership harder to save for would be more picky when they did manage to buy. It just clicked that the millennial they interviewed bought a house in an old neighborhood with a lot of gentrification happening, which changes the pickiness question into whether it is a millennial thing or a gentrification thing, which the article doesn't touch. I'm not sure Dallas does gentrification very well either though -- seems to be about rebuilding or adding on to max the square footage and slapping granite countertops all over. That's another reason millennials are buying fewer houses here. The square footage has skewed bigger. The neighborhood I was born in had a bunch of 1000 or 1400 square foot houses and in the last 10 years most of them have been rebuilt to 2 or 3 thousand.

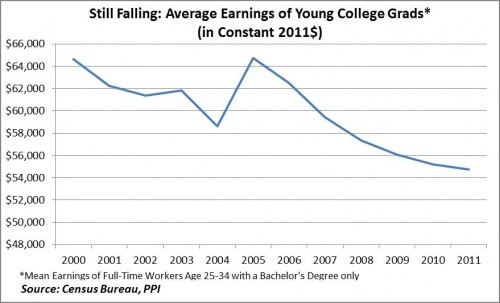

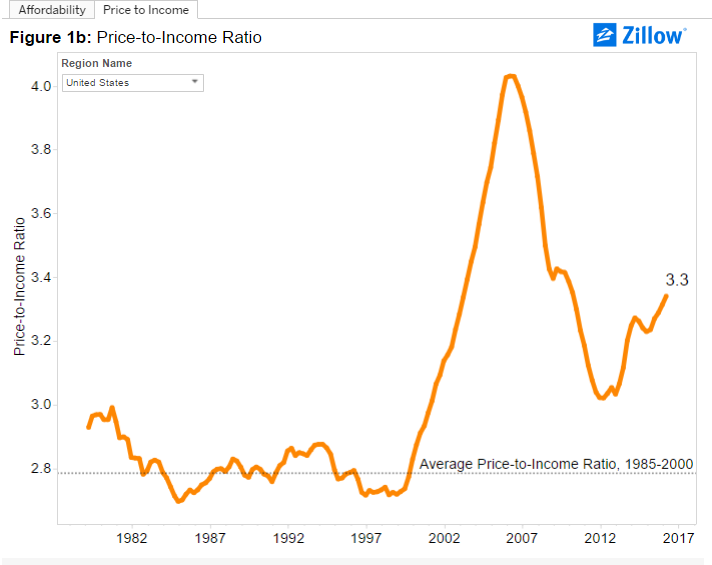

It's a total red herring. Here's the quote: They also want community, connectivity and inclusiveness, said Tony Ruggeri, the millennial co-CEO of Republic Property Group, a developer that is building large communities at Light Farms in Prosper and Walsh in Fort Worth. "We're not doing golf courses anymore, we're doing food and beverage," Ruggeri said. "And the concept of walls and gates, the instinct to insulate yourself from the outside world, that's completely inverted." So, they don't want picket fences, gates, or golf courses. They do want a house they can move into that doesn't need a bunch of rehabbing. Somehow that's "particular" as if the idea of renovating a home before selling it is this appalling ritual realtors have never been subjected to. You wanna see why millennials are buying fewer houses? It's gonna take me two graphs: My wife - nine months out of college - was making $65k a year in 1999. In February 2000 she bought a 1300sqft mid-century with 3 beds and 2 baths in a major metropolitan area within walking distance of a metro park'n'ride for $175k. We're not talking hoary rimes of 'boomers and Levittowns. We're talking "people who saw Green Day in college." That house is now $425k and that salary is now $56k a year. "Picky?" Good thing their parents are chipping in. For more than mortgage assistance. Let's spell this out, shall we? If you're under 35 and buying a home, there's a 1 in 5 chance that mommy and daddy are giving you the downpayment. Which is entirely appropriate because there's a 4 in 5 chance they're giving you money for rent and bills already. Great economy amirite?The pickiness point struck out to me, it makes sense that a cohort with house ownership harder to save for would be more picky when they did manage to buy.

"They're pretty particular," Barrios said. "They want a good price, something that's eco-friendly and something that's recently updated. You know, it's instant gratification. We all work a lot, so we don't have the time to do a renovation when we buy."

A recent survey by loanDepot shows that 17% of the parents of millennial children (defined here as between ages 18-35) expect to help their children buy a home within the next five years. That’s an increase of over 30% compared to the previous five years, when 13% of parents expected to provide home-buying assistance.

Most of the parents offering financial support for their children who are over 18 have either helped with living expenses (84%) or given their child (or children) money to pay down debt (70%).

Houses are very expensive now, if you don't work in tech or some other lucrative field. $300K+ doesn't seem like much to someone making upper middle class money or better, especially if your income stream is stable. For families closer to the middle class, especially in an unstable job situation, it seems unreasonable.

Not gonna lie. The waterfront properties I fantasize about? I check their height above sea level. There's a great piece of property I've been following for a long time. It used to be a "fixer upper" because the neighbor's property sloughed off onto it and crushed half the house. It went from $1.9m to $475k with a creak and a groan. Now it's $300k with a house to haul off. The neighbor's house went on sale about four months ago... and sold for $2.3m. There was absolutely no notes in the listing about "subsidence" or "landslides" or "shoring" or any of that shit.

I thought you were going to go the direction of "will need to move in a couple years because of layoffs or limited growth at a company."

By the numbers, my wife and I are far better off renting an apartment and saving the difference between a mortgage and rent, instead of competing with this market. Also, odds are we will move more than once inside DFW before picking a place to stay long enough to make buying a good idea.

Yes I have played with that. Our situation isn't an apples to apples comparison: here, renting a house is more expensive than buying one, but renting is usually cheaper than buying for apartments/townhomes, especially the small ones. And we don't need more than a 1 br place for now, and won't need bigger for a few years. So we are better off renting what we need now instead of buying what we will want later.