I'll admit, I'm proud of myself for coming up with that one. :) Curiosity got the best of me, so I skimmed the article and did some basic googling. If I understand it correctly they started with a profit over earnings ratio, but used a 10-year earnings average in the denominator which he calls CAPE since it smooths out over cycles. (Was that what he got his Nobel for?!) Hussman then calculates his "CAPEh" in here: If that's par for the course over in Investor Land®, I don't understand how people fall for this crap. Something something fooling some people all of the time...

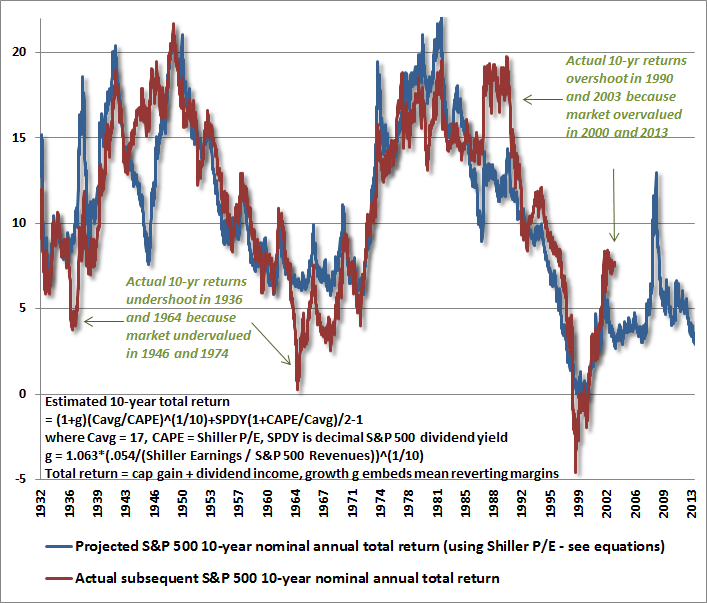

Dude. Dude. We're talking business majors, that didn't go into accounting, whose primary skill is buying and selling something designed to be bought and sold, whose job it is to predict when things are bought and sold. Remind me - did you read Piketty? Did you notice how every time he resorted to algebra he apologized profusely? Yeah - Schiller got a Nobel for CAPE ratios. Which are literally inflation-adjusted profit-to-earnings. but how are we supposed to do that, egghead? Look at the yearly earning of the S&P 500 for each of the past ten years. Adjust these earnings for inflation, using the CPI (ie: quote each earnings figure in 2017 dollars) Average these values (ie: add them up and divide by ten), giving us e10. Then take the current Price of the S&P 500 and divide by e10. Why ten? Because fuck you, that's why. Anybody in economics serve ten year terms? Anybody in politics? It's too long for tequila and wine, too short for every scotch but one (holy shit: Laphroag is the secret underlying economic research!) and only makes sense in terms of "well, why not ten." But ignore that for a minute. Did you see the part where they explained how to take an average? Do you see that often? The only place I'm used to seeing them explain averages for schlubs who might not remember 5th grade math is economics sites. And then they usually throw some crazy fucking curve up there and start talking about Elliott Wave Theory or some shit. You are now aware that the US Federal Reserve makes most of its predictions and prognostications based on the Phillips Curve. Check out the higher-order math on that guy. I mean, shit. It's got subscripts and superscripts and lambdas and all sorts of crazy mathy stuff but dig into it, and it's basically a bunch of bullshit coefficients having a fight to yield a correlation. Math is like the catalyst in economics. It is essential in order to make it happen but it is neither consumed nor destroyed.To calculate P/E10:

No wonder they see quants/HF traders as earthbound Gods. You'd think there would be a whole school of economics devoted to differential-equations-based modelling, but I can't find much of anything. I have not read Piketty, although I vaguely recall asking you about whether I should read it two, three years ago. You described it as a long and boring economics Powerpoint presentation. Considering I thought Graeber was longwinded, I never attempted Piketty's 25 Hour "..and then there's this graph" Extravaganza. But hey, between then and now I read Zinn and Pinker in less than six weeks, so if you think it can keep me engaged I can give it a shot.

I say do it. You kind of have to let it wash over you - it's a lot less engaging than Zinn or Pinker. I'd put it about on par with Mohammed Said from a prose standpoint and not quite as engaging as Judt. But as you do it, it's kind of a "....well holy shit" experience.