- The goal is to create a mechanism where the optimal strategy is simple. First, you personally decide what is the highest valuation you would be willing to buy at (call it V). Then, when the sale starts, you don’t buy in immediately; rather, you wait until the valuation drops to below that level, and then send your transaction.

There are two possible outcomes:

The sale closes before the valuation drops to below V. Then, you are happy because you stayed out of what you thought is a bad deal. The sale closes after the valuation drops to below V. Then, you sent your transaction, and you are happy because you got into what you thought is a good deal.

However, many people predicted that because of “fear of missing out” (FOMO), many people would just “irrationally” buy in at the first day, without even looking at the valuation. And this is exactly what happened: the sale finished in a few hours, with the result that the sale reached its cap of $12.5 million when it was only selling about 5% of all tokens that would be in existence - an implied valuation of over $300 million.

All of this would of course be an excellent piece of confirming evidence for the narrative that markets are totally irrational, people don’t think clearly before throwing in large quantities of money (and often, as a subtext, that the entire space needs to be somehow suppressed to prevent further exuberance) if it weren’t for one inconvenient fact: the traders who bought into the sale were right.

Greed reigns over the land... I think there may be money to made but I'm sure as hell not going to play that game. ICOs are moneygrabs for the lucky few who (are rich enough to) get in - the quality of the product is not as important as the quantity of hype. By the way, the fact that Vitalik is three months younger than me blows my mind. Fascinating guy.

I found one buried in an /r/ethtrader post somewhere: https://icostats.com/. Specifically, check out ROI since ICO in the sidebar and toggle ETH in the top right corner.

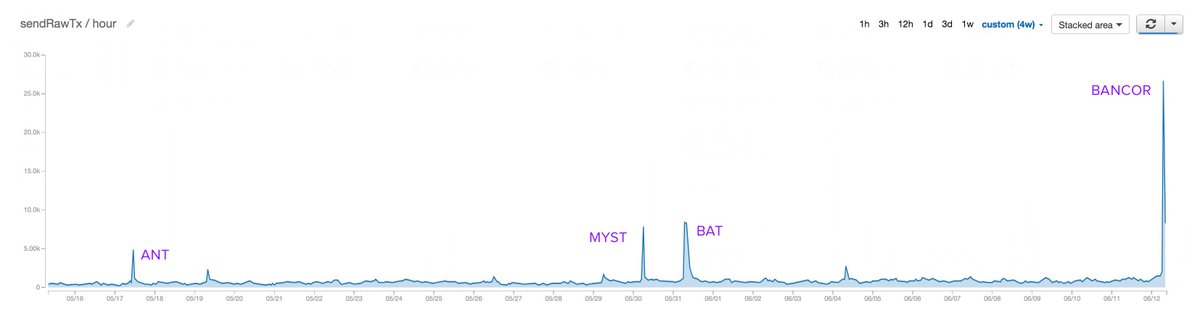

Thus, we are starting to see capped sales approach their natural equilibrium: people trying to outbid each other’s transaction fees, to the point where potentially millions of dollars of surplus would be burned into the hands of miners. And that’s before the next stage starts: large mining pools butting into the start of the line and just buying up all of the tokens themselves before anyone else can.