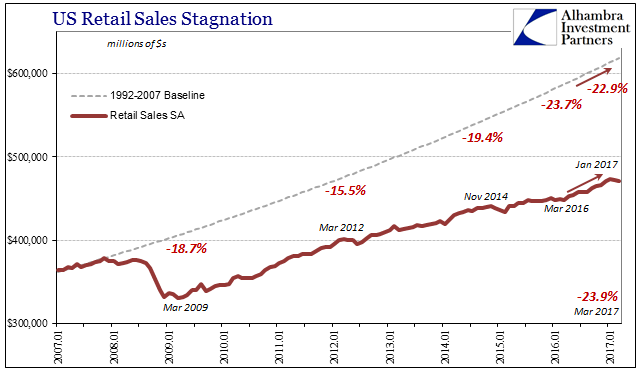

There's some confusion about cause and effect here, as well as some handwaving to discount the very real decline in retail sales. Yeah you called it the "retail apocalypse" just one sentence previously. Nobody is fucking around with that sobriquet. If 4% growth is stagnant than 9% of total sales doesn't get to be an "only." That's not at all what the Bloomberg article says. The Bloomberg article says "oh holy fuck y'all it's about to get hella, hella worse." Wanna see why? The New Republic article actually makes the misunderstanding worse: Bitch please. SO HERE'S THE REAL PROBLEM That scary high-yield credit plummet indicates that investors in the bond market are less and less interested in buying high-yield bonds. Federal interest rates have no direct impact on bond rates; a bond is Toys'R'Us saying "if you lend us x money for y years we'll pay you back z." Considering Toys'r'Us is a lot riskier than a federally-guaranteed loan, you invest with Toys'R'Us because "z" is hella better than what you can get by loaning your money to a bank. It's worth noting that Toys'R'Us couldn't refinance $400m. Argentina oversold $2.75b on a 100 year bond and they default on their debts every 30 years or so on average. In other words, the bond market would rather deal with the return of Pinochet right now than lend money to retail. This, in an environment where: • Bitcoin (which may be worthless) soared nearly 700% from $952 to ~$8000. • The Bank of Japan and the European Central Bank bought $2 trillion of assets. • Global debt rose above $225 trillion to more than 324% of global GDP. • US corporations sold a record $1.75 trillion in bonds. • European high-yield bonds traded at a yield under 2%. • Argentina, a serial defaulter, sold 100-year bonds in an oversubscribed offer. • Illinois, hopelessly insolvent, sold 3.75% bonds to bondholders fighting for allocations. • Global stock market capitalization skyrocketed by $15 trillion to over $85 trillion and a record 113% of global GDP. • The market cap of the FANGs increased by more than $1 trillion. • S&P 500 volatility dropped to 50-year lows and Treasury volatility to 30-year lows. • Money-losing Tesla Inc. sold 5% bonds with no covenants as it burned $4+ billion in cash and produced very few cars. (source) So. The "Retail Apocalypse is happening because nobody is buying anything" but "compared to what we're about to see, maybe we should call the 'retail apocalypse' the 'retail squall' because this:" Is insanity. Ain't nobody out there going "oooooh goody goody! A shuttered Sears to move my new department store into!" A shut Sears is a George Romero film, not a rent-gouging opportunity.This story is at odds with the broader narrative about business in America: The economy is growing, unemployment is low, and consumer confidence is at a decade-long high.

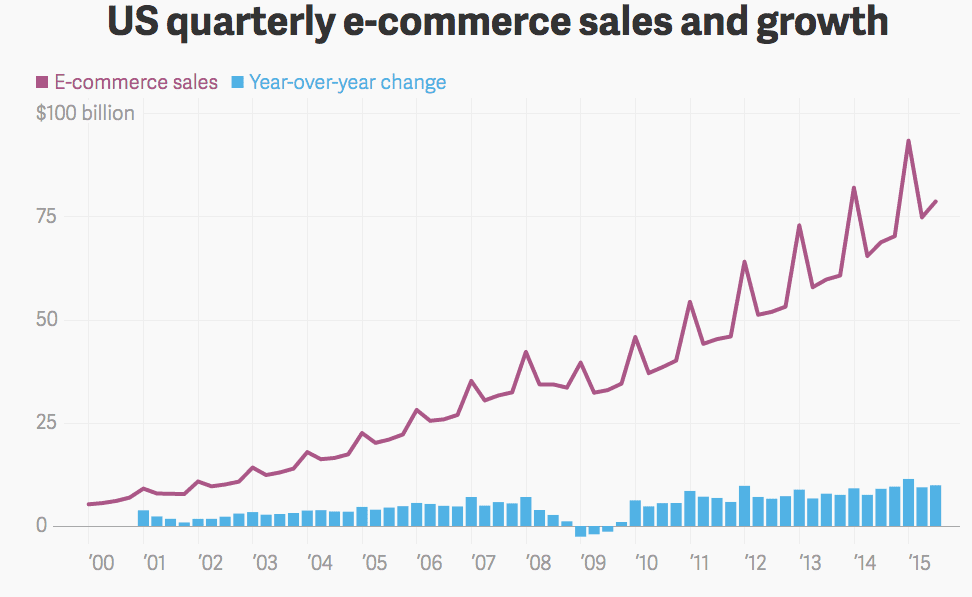

Some point to Amazon and other online retailers for wrestling away market share, but e-commerce sales in the second quarter of 2017 only hit 8.9 percent of total sales. There’s still plenty of opportunity for retail outlets with physical space.

The real reason so many companies are sick, as Bloomberg explained in a recent feature, has to do with debt. Private equity firms purchased numerous chain retailers over the past decade, loading them up with unsustainable debt payments as part of a disastrous business strategy.

Typically retail firms roll over debt to buy time, but interest rates have risen since the last set of buyouts several years ago, making that prospect more expensive.

• A painting (which may be fake) sold for $450 million.

As a shareholder of Seritage, Lampert’s hedge funds can profit from higher rents charged to new retail outlets that move into the shuttered Sears locations.