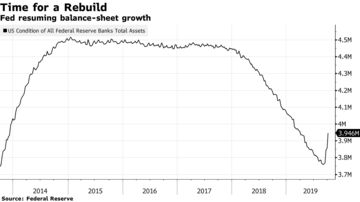

This is going to be a longer discussion than you bargained for, but there's a key concept we need to go over first. Are you familiar with Heisenberg's Uncertainty Principle? You probably think you are. I often do. Pop-sci cribnote on the Uncertainty Principle is that you can't know a particle's momentum and position at the same time and that if you investigate for one, you force the other. Really, that's the observer effect which just gets really weird at a quantum level but since economics REALLY wants to have some mathematical or physical basis in reality people ascribe Heisenberg's Uncertainty Principle to things where it doesn't belong. But there's a reason for this: Fundamentally, reporting the market is manipulating the market. You might not remember the Gulf War - everyone knew that everyone knew that Saddam Hussein took out the Twin Towers and anyone showing you videos of Iranians holding candlelight vigils for the World Trade Center hated freedom. If you didn't want us to invade Baghdad you hated freedom and if you stepped out of line you were over, just ask Natalie Maines. That doesn't mean that it was a good idea to invade Iraq, or that Iraq had anything to do with the World Trade Center, but it meant that the zeitgeist was gonna fuckin' take out Iraq. Fast forward fifteen years and even the patent obviousness of the stupidity of the war in Iraq hasn't been enough to wash the protestors of their stink. Bernie Sanders is still a radical for being right and Hillary Clinton was just "following conventional wisdom" for going along with a war she knew was a pointless wet dream of the PNAC. Here's the thing: the further you are from raw data, the more "consensus view" you see and it doesn't get much further from raw data than end-of-day business summaries on broadcast television. It takes time to turn around a television show and if you actually have to go out and show something you probably got the footage two or three days ago and once you've spent the money on the footage you're damn well running the report; this is how 60 minutes ends up running bullshit bits like MurderAudis. And the really terrible part is you didn't notice the sleight of hand where you asked for "business news" and I told you about the stock market. Because the stock market is the economy now. The only figures anyone will tell you about is whether the Dow, the S&P or Nasdaq are up or down. All we care about is the tickers - they're the applause-o-meter of the modern economy and the "metric" by which we know if we're fucked or not. So what you're asking for is a highly-produced slow-motion recap of the clap level recorded in response to business data parsed and contrived and manipulated for maximum applause. This is David Rosenberg. He was one of the few insiders ringing alarm bells in 2006 about impending market doom. He was labeled a "perma bear" and fired. Then the market tanked and he became a "market prognosticator" and got set up with a bitchin' gig in Canada. Then in 2017 he started saying things like "we're in the 7th inning on this economy" and got labled a "perma bear" again. Here's the thing: if you're right when everyone else is wrong, you might make a lot of money but you'll never be oneofUS oneofUS oneofUS ever again. If you're wrong when everyone else is wrong you won't even get into trouble; after all, who could have foreseen the mortgage crisis! After all, it was a "six sigma" event! (that means that someone proved mathematically that the odds of housing values going down any time soon were 500,000,000:1... which didn't make people re-run their models, it made them pile money into mortgages because that's what they wanted to do anyway) Look - when Obama was president and the whole country was at DO SOMETHING they put Tim F'n Geithner on The Daily Show to explain why everyone knows that everyone knows that the banks that destroyed the economy needed to be given giant piles of cash or The Great Humungous will eat our Alpo. But since everything is going GRRRRRRRRREAT in the market right now the only people talking about this are me and mk: So. In answer to your question, the business news is deliberately obfuscatory, meandering and sensationalized. We aren't even counting the things that matter anymore. When housing prices are up, sales being down is a sign that the economy is going great. When housing prices are down, sales being up is a sign that the economy is going great. there are actual data points out there that matter, but when the economy is the market and the market is 80% HFT bots spitting at each other 10 times per microsecond they aren't even part of the discussion. Five, six years from now there will be a bunch of intellectual thought pieces about how we let everything get completely out of control. Michael Lewis will explain things in a pithy and entertaining way and everyone will think "glad we never have to go through that again" and the pile will rebuild. In the meantime... I drink from the firehose. I'm not suggesting you do the same... not much, anyway. But of the 20-plus pieces of content I get every day, I'm going to recommend two to you: 1) SeekingAlpha's Wall Street Breakfast. It's basically a condensation of the day's big stuff in Barron's, WSJ, FT, Fortune, Inc and assorted other lesser players. It'll take you about five minutes to read and give you a general overview of what the chattering class is on about. I get it as an email. I skim it and dig deeper on anything that actually interests me, which generally happens two or three times a week. 2) The Wall Street Journal's Daily Shot. This is literally nothing but an ungainly pile of graphs and charts. Obviously you can't create a chart without injecting some context through the simple choice of variables but the fact that there's no narrative means you're seeing less influence. I generally scroll through the first half or so of this thing; that takes you pretty much through the USA and Canada and sometimes England. Don't try to make sense of any of it, don't try to internalize any of it, but if something lodges in your brain or looks obvious (like that FRED chart above), dig deeper. Fundamentally, a lot of economic data is noisy AF and can't really be parsed in a useful way, which of course doesn't stop everyone from trying. If you see something, try and find someone on the Internet talking about it. That'll generally point you somewhere else and before too long you'll have an opinion. Wish that was less diatribe-ey and more helpful but there it is.